I saw some coverage today regarding the innovation in medtech in 2013, but I was surprised to see that it was limited to coverage of the companies who received PMA approvals and didn’t detail the specific technologies or where these technologies arose (by country or state).

Therefore, I thought I would detail the innovation in medtech that I have seen in 2013 based on the number of medtech startups for the year, what the specific technologies were, and the country and, if USA, the state.

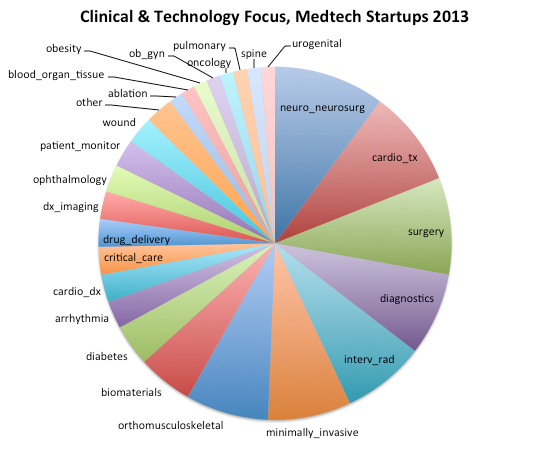

So, below are the technologies under development at medtech startups:

I saw some coverage today regarding the innovation in medtech in 2013, but I was surprised to see that it was limited to coverage of the companies who received PMA approvals and didn’t detail the specific technologies or where these technologies arose (by country or state).

Therefore, I thought I would detail the innovation in medtech that I have seen in 2013 based on the number of medtech startups for the year, what the specific technologies were, and the country and, if USA, the state.

So, below are the technologies under development at medtech startups:

- Biomatarials for bone regeneration.

- Vascular drill to cross chronic total obstructions and facilitate balloon angioplasty and stunting.

- Non-invasive, migraine therapy device worn on the back of the head at the onset of or during a migraine to relieve pain.

- Endoscopic, minimally-invasive harvesting of veins used for coronary artery bypass grafting.

- Detection of concussion.

- Various medical devices, including a device to assist laparoscopic surgery and pain management device.

- Undisclosed technology for the treatment of aneurysm.

- Implantable electrospun neurosurgical meshes and tools.

- Undisclosed medical technology development. Affiliated with [VC firm].

- Undisclosed medical technology relating to allografts.

- Developing “generic” versions of medical technology.

- 3D live, microscopic imaging technology for in vitro and in vivo use.

- Undisclosed neuro technology.

- Developing a leadless implantable cardioverter defibrillator.

- Implant remote sensor technology.

- Intramedullary rods and other orthopedic implants.

- Single-use device to prevent postpartum hemorrhage.

- Products for weaning from mechanical ventilation and use for patients with COPD.

- Undisclosed spine treatment.

- Left ventricular assist device.

- Hypothermia device for patients with cardiac arrest, traumatic brain injury, stroke and concussion.

- Systems for minimally invasive knee implants.

- Hemostat/sealant.

- Noninvasive blood glucose monitor.

- Device to reduce sternal bleeding associated with cardiac surgery.

- Lightweight and low cost 12-lead diagnostic ECG device.

- Ultrasound-based brain noninvasive physiology measurement of cerebral blood flow and intracranial volumetric wave monitoring.

- Device for the management of urinary incontinence.

- Haptic device used in rehabilitation following stroke or neurological injury.

- Biodegradable sealants and adhesives in surgery.

- Developing a device that mimics the actions of gastric bypass surgery for the treatment of obesity and Type 2 diabetes.

- Embolectomy devices

- Ocular stent for treating age-based vision changes.

- Ophthalmic device company focusing on age-related macular degeneration, diabetic retinopathy, retinitis pigmentosa, hemianopia, and glaucoma.

- Neuroscience-based technology (neuromodulation) for enhancing performance on cognitive tasks, for the healthy and impaired.

- Portable, ultrasound-based device non-invasive, transcranial diagnosis of stroke.

- Temporary cardiac pacing as treatment for reversible symptomatic bradycardia.

- Use of biomaterials in aesthetics for non-surgical temporary & permanent breast and buttock enhancement, facial rejuvination solutions and adipose tissue engineering related therapies.

- Custom surgical implants including using 3D printing.

- Device to harvest bone grafts

- Magnetoencephalography and magnetocardiography.

- Devices for cardiac and vascular procedures designed for easier use and lower cost.

- Radiofrequency ablation probe for the treatment of breast cancer.

- Laparoscopic instruments designed to make surgeries less invasive and produce no scarring.

- Insulin delivery alternative to pens and syringes.

- Orthopedic implant technologies including a force sensor to measure performance of an orthopedic articular joint.

- Insulin patch pump for treatment of insulin-dependent type 2 diabetes.

This is a wide range of technologies. To distill it down and summarize it, below is the distribution of the clinical or technology categories into which these fall. (Note that multiple categories are possible, such as “minimally invasive” and “surgery”.)

Source: Medtech Startups Database, MedMarket Diligence, LLC

The bulk of medtech startups we identify are from the U.S., both due to the fact that most medtech startups globally are in the U.S. and that it is simply easier for us to identify U.S. startups. Here is the distribution nonetheless:

Source: Medtech Startups Database, MedMarket Diligence, LLC

Within the U.S., there is a wide distribution of states where this technology resides and, while there is typically a dominance of companies in California, there has been a shift in recent years as state-based initiatives and incentives (include tax-based) drive creation of more startups in other states. Below is the distribution of 2013 U.S. medtech companies by state.