Since 2008, medtech has taken a lot of hits. Indeed, when the capital crunch hit, medtech was not viewed as the safest place for investment by a suddenly very risk averse world. Blue chip stock, high volume, low growth, STABLE markets became the norm for a lot of money.

Since 2008, medtech has taken a lot of hits. Indeed, when the capital crunch hit, medtech was not viewed as the safest place for investment by a suddenly very risk averse world. Blue chip stock, high volume, low growth, STABLE markets became the norm for a lot of money. But, after a short while, it became apparent that medtech was hardly junk bonds or penny stock, especially considering the battle-hardened innovators of medtech who continued to seize on innovations that provided treatment where there once wasn’t, that accelerated healing, that measurably improved outcomes, that resulted in real cost savings to health systems and insurers, that, in other words, met DEMAND.

So, money came back to medtech. I tracked it then, and I track it now, month by month, funding by funding, company by company. Was it coming back in the pollyanna-esque windfalls of biotech and pharma? No, and I don’t think it ever has or ever will — nor should it. Biotech seems to perennially able to tap the “hope springs eternal” deep pockets of venture capital that can regularly draw individual fundings of $50 million, $75 million or $100 million. Pharmaceuticals don’t seem to go to the VC well as often, but when they do, their funding rounds are no less spectacular.

Medtech excels at crafting plain and simple solutions to disease, suffering, high healthcare costs and clinical need. Not every solution is a blockbuster — in fact, there are more than a few 510(k) products that should probably just be called “me, too”, since they do not distinguish themselves independently, at least not from a clinical or technology standpoint. But medtech has proven its ability to keep pushing the treatment envelope by innovating a little further to gain a bit more edge on outcome or cost or both.

So, medtech regularly pulls in $5 million, $10 million, $25 million at at time — frequently less, but not infrequently more.

My Contrarian View. But let me highlight again that medtech is a moving target and not everyone is thinking apples to your oranges. What I consider medtech is, at its root, technologies that were traditionally represented as medical device treatments for disease and trauma. (And, yes, so I don’t have to answer this later on, by “medical device” I mean implants, instruments, instrumentation, even capital equipment.) But medtech is not only medical device, for it is also (at least by my authoritarian definition, since this is my blog, but it is read by many in this field), anything and everything (within reason) that is either adjunctive to medical devices like drug delivery, like biomaterial-based implants/grafts, drug/device hybrids, tissue engineering and cell therapy (this latter is perhaps at the fringe of medtech, bordering on pure biotech).

Where’s the boundary of medtech? In my mind, it is anything and everything that competes with markets that have in the past and are to some extent still served by medical devices, equipment and supplies. For the sake of repetition, this is the definition I have posted on the medtech fundings I report on month by month in this blog (and in the online spreadsheets linked here):

What is “medtech”?: We view medical technology (medtech) as principally medical devices and equipment, but also all technologies that are directly competitive with or complementary to technologies represented by therapeutic or diagnostic medical devices/equipment.

Note: Historic coverage of “medtech” has been limited to medical devices, supplies and equipment. We feel that such a limited definition poorly reflects the true nature of the markets that once were limited to such products. In reality, assessing the markets and competition for medical devices by ONLY considering other medical devices would result in gross underestimations of both competition and market potential. Moreover, this is reflected in both the nature of medical devices (which may be hybrid device/bio/pharm products or products that may not be “devices” at all (especially in the typical definitions defined by material type and function) but that compete head-on with devices.

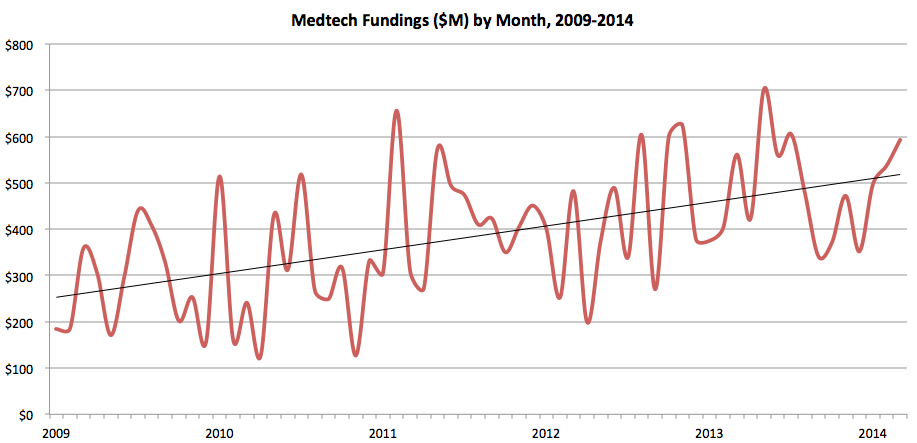

So, on this more liberal definition of medtech (which some still feel is too restrictive), I can point to a steady stream of investments that has been on an upward trend for the last five years. If you disagree, feel free to come up with your own definition(s), but here is the five year trend of medtech investment:

Source: MedMarket Diligence, LLC

Looked at from a seasonal standpoint, this data is shown below:

Source: MedMarket Diligence, LLC

The monthly data underlying both of these charts is at link. If that is not enough data for you, then you can look at a comprehensive listing of the individual fundings behind this at link.