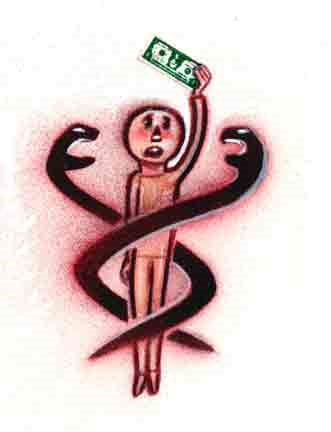

Back in 1993, the economists Jonathan Gruber and Brigitte C. Madrian highlighted the problem of “job lock”, a consequence of employer-based health benefits. Gruber and Madrian figured if people with a serious health problem left their jobs, they would be subject to medical underwriting and be charged high premiums or perhaps be denied coverage altogether if they entered the individual market. So they stay in their jobs to buy the insurance their employers provide.

Back in 1993, the economists Jonathan Gruber and Brigitte C. Madrian highlighted the problem of “job lock”, a consequence of employer-based health benefits. Gruber and Madrian figured if people with a serious health problem left their jobs, they would be subject to medical underwriting and be charged high premiums or perhaps be denied coverage altogether if they entered the individual market. So they stay in their jobs to buy the insurance their employers provide.

The problem is also reduced by HIPAA, a 1996 federal law which required employers to offer benefits to new employees on the same term as incumbent employees, without medical underwriting, if the new employees had previous long-term coverage without a significant lapse (literally, at least six months coverage without a lapse of more than 63 days).

Yet, one justification for ObamaCare is that it will end this (perhaps non-existent) job lock. An article in Bloomberg News on September 9, 2013 asserted that ObamaCare would unleash a tsunami of entrepreneurship, reporting a conclusion by two university researchers that ObamaCare would free almost a million entrepreneurs from the shackles of employment-based health benefits.

This estimate was derived by extrapolating from the experience of TennCare, an expansion of Tennessee’s Medicaid program. Tennessee rolled back TennCare in 2004, dropping 170,000 people, mostly childless adults from the rolls. This was a drop of 6.9 percent in the proportion of childless adults on Medicaid. The result was an increase in the labor supply: The proportion of childless adults with jobs went up by 5.7 percent in the same period, much more than any other state. Remarkably, the authors describe this as “job lock”.

Obviously, losing Medicaid caused these people to seek employment. However, cuts in food stamps or cash welfare would have achieved the same result. Describing this as their having entered into “job lock” is as absurd as describing them as suffering from “wage lock”. It is grotesque to describe their situation in the same breath as that of working people who earn health benefits as compensation for their employment. If those Tennesseans were to lose their employer-based benefits because of ObamaCare, they would not likely become entrepreneurs. Rather, they will become unemployed again.

Of course, working people should be free to take their compensation in whatever form they and their employers agree, without the Internal Revenue Code introducing a bias in favor of health benefits over cash. Fixing this quirk of the tax code should not be rocket science. For example, in Priceless, John C. Goodman recommends a fixed tax credit to each household in the country, which could be paid for by amending the exclusion of employer-based health benefits from taxable income.

ObamaCare neither fixes job lock nor unleashes entrepreneurship. Rather, it will suppress entrepreneurship and employment through tax hikes and increased welfare payments.