In 1900, if you manufactured buggy whips, did you see yourself in the buggy whip industry — or the transportation industry?

In 1900, if you manufactured buggy whips, did you see yourself in the buggy whip industry — or the transportation industry?

I am not a big believer in conventional wisdom. Yes, of course, conventional wisdom does get things right sometimes, but the problem with conventional wisdom is that (here’s the problem) it is sometimes failingly conventional. That means it tends to be stuck with entrenched definitions and ways of looking at the world that tend to miss the fact that the world is not a statue that can be admired from different angles, but a moving, dynamic, fluid object that can only be understood from a moving perspective.

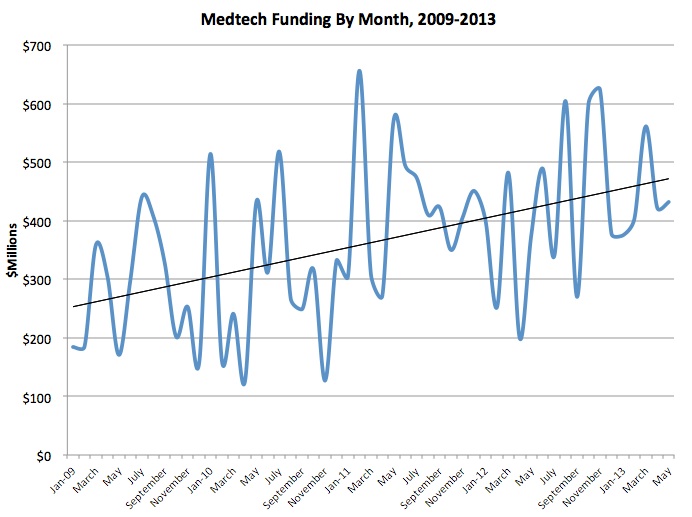

So, conventional wisdom has it that investment in medical technology is down. I don’t buy it. I have seen the emergence of so many new medtech companies, even since the Great Recession of 2008 (see link). I have witnessed hundreds of millions of dollars flow into medtech — early-, mid-, late-stage and the occasional IPO — and I have tracked those dollars. Below is the month-by-month tally of medtech investment from 2009 through 2013:

Source: Compiled by MedMarket Diligence, LLC (data at link)

Here’s what I will buy:

- Investors are increasingly inclined to delay investments in later-stage medtech as a hedge against risk. They want to see highly promising clinical results and strong indicators that the FDA will reach decision to approve before they lay their money down.

- Early-stage medtech companies are now less likely to derive funding from outside investment than they are from outright acquisition. Face it, new technologies are risky and costs of development to get through the R&D and regulatory minefield are high. At the same time, big medtech companies don’t have great incentive to carry expensive R&D activity on the books when they can alternatively bide their time watching young medtechs until the time is right to buy them up along with their fervent entrepreneurs committed to commercial success of their new widget.

- Yesterday’s medtech is not today’s medtech (see link). Devices no longer compete against other, similar devices alone. They compete against any and all therapeutic alternatives to achieve the same desired clinical outcome. Therefore, if you are analyzing medtech, you can’t just consider coronary stents and angioplasty in their varied embodiments. You have to also consider their competitors (and isn’t a medtech competitor also a medtech?) to be any and all therapeutic options targeting that same endpoint. Hence, you have to look at Esperion Therapeutics for their cholesterol lowering drugs (BTW, Esperion just filed for IPO, so count that in, too).

The forces and developments that dictate success and failure evolve as new technologies, new operating practices, new variables are injected into the equation.

I am therefore left with the old business school adage about the buggy whip manufacturers I alluded to earlier. What is your industry? Horse motivation, or transportation?