Since January 2011, a total of 245 new medtech companies have been founded and added to the Medtech Startups Database from MedMarket Diligence. These are companies that are either device-based or based on other technologies that are directly competitive with, or complementary to, medical devices, inclusive of medical device implants, med/surg instruments or equipment, drug/device or biotech/device hybrids, bioresorable implants/devices and other similar technologies.

Since January 2011, a total of 245 new medtech companies have been founded and added to the Medtech Startups Database from MedMarket Diligence. These are companies that are either device-based or based on other technologies that are directly competitive with, or complementary to, medical devices, inclusive of medical device implants, med/surg instruments or equipment, drug/device or biotech/device hybrids, bioresorable implants/devices and other similar technologies. The companies excluded from this are those that are developign pure pharmaceutical products with no direct competitive/complementary role with medical devices or hybrids of info technology (e.g., smart-phone) piggybacked on existing medical devices.

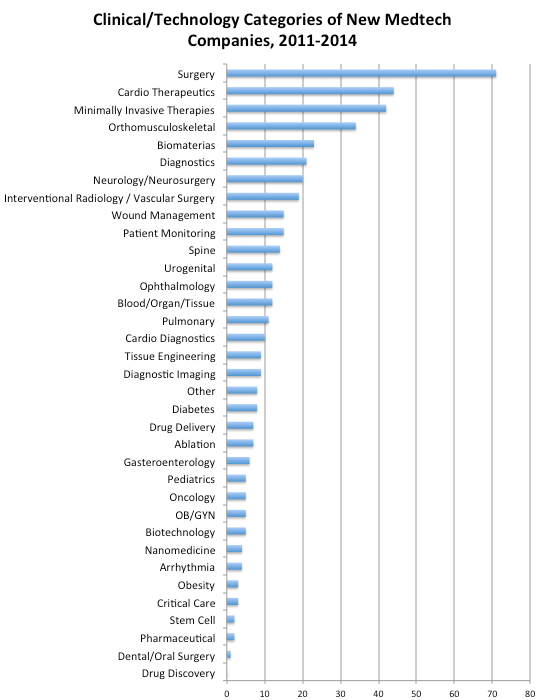

The companies represented here cover a surprising range of innovations and clinical applications. They have been identified based on recently issued patents, patent applications, corporate filings and a litany of press releases, social media sources, and other data sources. As we identify the companies during this process, we categorize them into a number of clinical/technology categories, with multiple categories possible (e.g., minimally invasive plus cardio therapeutics, or diagnostic plus oncology, and others). Below is illustrated, in descending order, the clinical/technology categories of the companies founded since January 2011:

Source: Medtech Startups Database; MedMarket Diligence, LLC

Clearly, the great majority of medical technology startup companies is focused on surgical and/or cardio therapeutics and/or minimally invasive and/or orthomusculoskeletal applications, areas that have historically and persistently represented the dominant thrust of medtech innovation.

Another way to view these companies is a “word cloud” compiled from each company’s product/technology descriptions, with the most frequently occurring words in the descriptions being represented in larger type face in the graphic:

Source: Medtech Startups Database; MedMarket Diligence, LLC