Introduction

Generally, women have the strength to multitask. They can take on different roles simultaneously such as being a career person, mother, spouse, homemaker and friend. Amidst all the tasks on women’s plate, there’s one thing that they should include in their to-do list and that is long term care planning.

Introduction

Generally, women have the strength to multitask. They can take on different roles simultaneously such as being a career person, mother, spouse, homemaker and friend. Amidst all the tasks on women’s plate, there’s one thing that they should include in their to-do list and that is long term care planning.

In one study1, MetLife found that 7 out of 10 women are worried about the long term care needs of their spouses as well as their own. Meanwhile, only 25% said that they have assessed the possible cost of care that they will incur in the future. This shows that women recognize the importance of being prepared yet only a handful of them are actually planning.

It is imperative for everyone to plan for long term care. For women, however, it is a more pressing issue. There are a lot of reasons why long term care is a major concern for the female group. Let’s look at each of them.

Women Live Longer

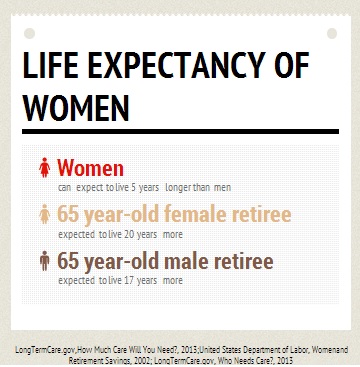

Longevity is one of the reasons why women should be more concerned about long term care. Women

can expect to live 5 years longer than men2. According to the United States Department of Labor, a

65-year-old female retiree can expect to live for two decades more while her male counterpart is only expected to live for another 17 years3. Meanwhile, a MetLife study

found that 1.3 M early boomers – those born between 1946 and 1955—are women and by 2020, their number is expected to grow to 2 million4.

Since women will live longer, they will also need long term care for extensive periods of time. On average, women will need long term care for 3.7 years while men will only rely on it for 2.2 years5. Note that these are just estimates, thus, a woman’s need for long term care may or may not be far more extensive than that. Regardless, it’s still important to put a plan in place for long term care.

Furthermore, women are likely to outlive their husbands. Since their spouses are no longer available to provide them with care, one of their options is to rely on paid care services. In fact, women account for 70% of nursing home residents and 75% of assisted living occupants.

Living longer is generally a good thing. However, it comes with a responsibility and that is to plan for contingencies such as long term care. Once you prepare for it, you can be rest assured that your quality of life will be maintained regardless of your age.

Women Are Primary Caregivers

Care provided by a family member is the backbone of long term care and majority of family caregivers are women. They make up for 59%-75% if individuals who provide informal care and the profile of a typical caregiver is 46 years old, female, working and earning a yearly income of $35,000. More so, it is found that women spend 50% more time in caregiving as opposed to men6.

Initially, most people turn to their families for care especially if their options are limited. When a parent or spouse becomes ill or frail, the right thing to do is to look after them. This responsibility usually falls to the wives and daughters. Though it’s the right thing to do, family caregiving can affect the lives of female caregivers significantly. In fact, 80% reported that caring for an elderly loved one have strained their relationship or marriage7. Meanwhile, 25% of women caregivers suffered from health problems, stress and symptoms of depression1.

Apart from the emotional and health toll of caregiving, women also experience job and income loss. As a result of providing care to a loved one, 64% of women had to use their sick or vacation leaves and 22% had to take leaves of absences. Meanwhile, 33% have reduced their work hours while 20% shifted from being a full-time employee to a part-time worker. On the other hand, taking leaves and decreasing work hours don’t seem to cut it for others as 16% quit their jobs entirely while 13% retired earlier than expected8. In 2012, 15.4 million caregivers have exerted 17.5 billion hours unpaid care and its dollar value is at $216 billion9.

Women caregivers also missed opportunities for them to hone their skills and advance in their careers. 29% declined a promotion, training or assignment while 25% turned down the opportunity for a job transfer. More so, 22% were hindered from developing new skills needed for the job while 13% failed to be at pace with the changes needed for their job skills8.

Though usually a labor of love, all the effects of caregiving can hinder women from anticipating the possibility that they too can be care recipients in the future. Recognizing its downsides early—from difficult time management, stress to income loss and missed career opportunities—should be a wake-up call for the female population and prompt them to take long term care planning to heart.

Women Have Lower Retirement Income

As mentioned earlier, women have a higher tendency to work part-time jobs or put their career

s on hold because of caregiving or other responsibilities. As a result, they save less for retirement or don’t

There are 62 million women wage-earners yet only 45% of them contribute to retirement plans3. If this figure doesn’t grow, we can expect a huge number of women struggling with retirement expenses.qualify for retirement plans at all. This can be alarming since it’s evident that women need to sock away as much as they can for their expenses later in life, including long term care.

More so, the longevity of the female group can affect their household income in the future. 37% of women aged 65 and above are widowed while only 12% of men have lost their wives10. Once a woman’s spouse is gone, her household income will be automatically cut in half or even more. In fact, a widowed woman aged 75 or above has a median household income of $14,600, while for a married couple in the same age, it’s $35,000.

If you’re a woman, you have the ability to change your retirement. If you are years away from being a senior, you still have a lot of time to save and plan. Take advantage of it. Meanwhile, if you’re approaching retirement, look into the different ways on how you can protect your retirement nest from long term care expenses.

Women Need Long Term Care Insurance More

Long term care insurance is the best way to protect retirement savings from long term care expenses. It’s essential for everyone to have but for women, it can be considered as a necessity. This is because they are more likely to tap into this policy’s benefits as opposed to men.

For every three dollars paid in long term care insurance claims, two of it goes to a female policyholder11. In fact, the largest claim—amounting to $1.8 million dollars—is being paid to a woman who bought her policy three years before she made a claim. Furthermore, once her benefits started kicking in, her premium payments have stopped12.

All the reasons previously mentioned—longevity, being a primary caregiver and lower retirement income—stresses that women need to reinforce their plan with long term care insurance. However, only 18% of female executives have bought a policy13. This can be disconcerting considering that those who are surveyed have jobs that make them financially capable to buy this type of insurance.

Earlier this year, leading long term care insurance providers have announced a new pricing system that will make women policyholders pay 24 to 40% more than men for the same policy14. This gender-based price hike may have discouraged most women from buying, but we would like to reiterate that they shouldn’t forego buying a policy. Though rates are higher for them, there are ways on how the price tag of long term care insurance can be reduced. Remember that the real risk comes from having no coverage at all.

What’s Next?

If you’re a woman, there’s no better time to plan for long term care than today. Start educating yourself about what it is and what preparations you need to make. From the internet alone, you can access a wide pool of resources and tools that can help make the process easier for you. You can also seek the advice of financial advisors, elder care attorneys and care managers. Likewise, you can consult your loved ones and friends who have experiences relating to long term care. Nothing beats a testimony that’s based from true events.

Meanwhile, if you have important women in your life such as your mother, spouse, friend or even daughter, share this information with them and make the preparation a team effort for the whole family.

Sources:

2 http://longtermcare.gov/the-basics/who-needs-care/

3 http://www.dol.gov/ebsa/publications/women.html

4 https://www.metlife.com/assets/cao/mmi/publications/studies/2010/mmi-early-boomers.pdf

5 http://longtermcare.gov/the-basics/how-much-care-will-you-need/

6 http://www.caregiver.org/caregiver/jsp/content_node.jsp?nodeid=892

7 http://www.caring.com/articles/love-and-marriage-when-caregiving

8 http://www.caregiving.org/data/jugglingstudy.pdf

9 http://www.alz.org/downloads/facts_figures_2013.pdf

10 http://www.aoa.gov/AoARoot/Aging_Statistics/Profile/2012/5.aspx

11 http://online.wsj.com/news/articles/SB10001424127887323622904578129460393048802

12 http://www.fpsinsurance.com/essentials/long-term-care/

13https://www.wiserwomen.org/images/imagefiles/MetLife.Study.Finances%20&%20Female%20Executives.pdf

14 http://www.reuters.com/article/2013/06/12/us-column-stern-advice-idUSBRE95B14F20130612