Walmart’s sheer size makes almost any of their initiatives newsworthy. That said, despite being a lightning rod for criticism on employee benefits and health care, they have introduced initiatives with far-reaching impacts. Their generic drug program began in September 2006 – more than 300 prescription drugs for $4/month or $10 for a 90-day supply – and was widely emulated, disrupting retail drug markets and generating immense social benefit. Imagine the difference it made to a lower middle class diabetic who had been paying more than $120 per month for medications, and suddenly could get them for about $24.

Walmart’s sheer size makes almost any of their initiatives newsworthy. That said, despite being a lightning rod for criticism on employee benefits and health care, they have introduced initiatives with far-reaching impacts. Their generic drug program began in September 2006 – more than 300 prescription drugs for $4/month or $10 for a 90-day supply – and was widely emulated, disrupting retail drug markets and generating immense social benefit. Imagine the difference it made to a lower middle class diabetic who had been paying more than $120 per month for medications, and suddenly could get them for about $24.

Yesterday Walmart announced that “enrolled associates” – covered workers and their family members – needing heart, spine or transplant surgeries could receive care with no out-of-pocket cost at 6 prominent health systems around the country: Mayo Clinics (Rochester, MN and Jacksonville, FL); Cleveland Clinic (Cleveland, OH); Geisinger Clinic (Danville, PA); Mercy Hospital Springfield (Springfield, MO); Scott & White Memorial Hospital (Temple, TX); and Virginia Mason Medical Center (Seattle, WA).

Walmart’s Center of Excellence (COE) program builds on its own and other organizations’ pioneering efforts with similar programs. Walmart developed a relationship with Mayo Clinics in 2007 for transplant and lung volume reduction surgeries. In March 2010, Lowes reached a similar arrangement with Cleveland Clinic for heart surgeries and, last December, Pepsico announced a global pricing deal with Johns Hopkins for cardiac and joint replacement surgeries.

It’s worth asking why these large firms would bother to do these deals for expensive care, and what this means for health care in the future. What’s different about the health systems that have been involved? Could these arrangements catch on and influence care elsewhere around the country?

The procedures involved are typically complex and high cost. Because they provide health coverage for more than a million people, Walmart has accumulated tremendous data and experience, and they are famous for their analytical acumen. They know that these kinds of treatments, though relatively infrequent, consume disproportionately high resources.

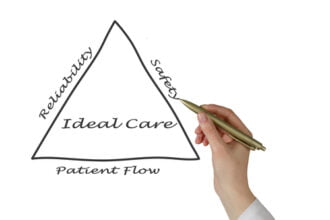

All of the organizations contracted in these arrangements have developed reputations for high quality. It’s worth noting that the unit pricing of their services can be high, but their episodic costs tend to be low. Their specialists are salaried, and therefore have no financial stake in ordering unnecessary services. And, in the words of a colleague knowledgeable about these efforts, “because they use evidence-based vs. money-driven care, they tend to get the diagnoses on complex cases right the first time. They also coordinate care and are more likely to be accountable than other systems.”

The press release also noted that Walmart’s COE program is “working with all the health care organizations to collectively share best practices that will allow collaboration around best measures of service and new industry findings in comparison to industry practices.” Think about that. Absent a health care environment that, as a practical matter, actively shares and translates evidence into practice, the purchaser, out of enlightened self-interest, has incorporated this process as a cornerstone element of its program.

One of my correspondents, a physician practicing at an academic medical center, commented on yesterday’s news:

“I recently reviewed … Texas hospital data. It is quite striking how Scott & White has markedly lower costs than most other equally sized Texas hospital systems while also hitting high marks for quality. I’d love, personally, to be able to take this press release to the head of our clinical practice and ask how we plan to compete in the future.”

He’s right. Health systems and specialty groups in the US have operated completely outside conventional market forces for decades, a fact that largely explains US health care’s ewithgregious cost, highly variable quality and rock-bottom value relative to health care in other industrialized nations. As the market becomes more cost-weary and price-sensitive, purchasers will follow the leads set by Walmart, Lowes and Pepsico. They’ll align with organizations that can measurably demonstrate better care at lower cost.

As market forces take hold, success will be associated with driving appropriateness, and with accepting lower per patient revenues in exchange for more market share and greater patient volumes. Growth will come at the expense of entrenched, less agile competitors.

The big winners here will be patients, who will be subjected to significantly less unnecessary risk associated with overtreatment, and purchasers, who will receive far better value at lower cost.

Health care organizations should not underestimate the significance of Walmart’s COE program. It is one of many signs suggesting that, after 40 years of being impervious to market forces, the health care bubble could burst. All it would take to change health care as we have come to know it is for more employers to collaborate and follow Walmart’s, Lowes’ and Pepsico’s leads. They would stop doing business with health care organizations that are unaccountable and don’t provide measurable value, and transfer that business to those that do.