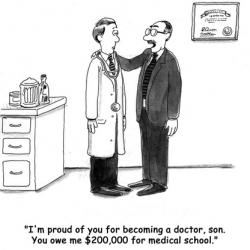

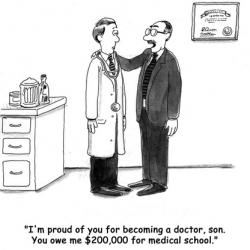

Each year, medical students incur more than $166,750 in medical school debt, according to the AAMC. Despite the organization’s conclusion that medical student debt is not a determining factor in choosing a medical specialty, the cost of education is a major concern for the future of health care.

Each year, medical students incur more than $166,750 in medical school debt, according to the AAMC. Despite the organization’s conclusion that medical student debt is not a determining factor in choosing a medical specialty, the cost of education is a major concern for the future of health care.

Medical students and physicians across the US have made extensive time commitments during their 20s to mastering the foundations of medicine and completing a residency. New physicians today face an exorbitant amount of debt that takes anywhere from 10 to 30 years to repay. We must continue to attract the brightest and smartest students into medicine without deterring them by cost. All Americans and the newly insured 32 million US citizens are counting on my generation to become the future of medicine. We cannot afford to let a price tag deter us from this responsibility.

Medical students and physicians across the US have made extensive time commitments during their 20s to mastering the foundations of medicine and completing a residency. New physicians today face an exorbitant amount of debt that takes anywhere from 10 to 30 years to repay. We must continue to attract the brightest and smartest students into medicine without deterring them by cost. All Americans and the newly insured 32 million US citizens are counting on my generation to become the future of medicine. We cannot afford to let a price tag deter us from this responsibility.

When a friend and I created our medical school’s first student state lobby day, the solution proposed by many legislators was to find a side job or take out more student loans. As any physician would know, medical students already work and study for more than 70 hours a week, which does not allow for earning a substantial side income.

I propose a unique business model, “Invest in a Medical Student’s Tuition Program,” (IMSTP) to help mitigate student loan debt. I began working on this idea three years ago, after I presented it to the AAMC’s Organization of Student Representatives. My goal is to create a new venture that would eliminate one of the two financial problems facing students: cost of tuition and interest rates. Because the cost of tuition is set by the university, I decided to tackle the 6.8 percent interest rate set by federal government Direct Loans.

I wondered, Could we curtail the total cost of medical students’ education by decreasing interest rates by 50 percent on loan repayments by creating a platform for private investment? IMSTP is a unique solution and the FIRST business model of its kind to help decrease the cost of attendance while incentivizing investors to make fiduciary investments in medical education.

Private investors would invest their money in a pool, from which medical students would draw their loans at a 3.4 percent interest rate. That’s half the interest rate that the U.S. Department of Education charges on its Direct Loan Program, the primary government loan program used by medical students. The lower interest rate would save students nearly $50,000 over the course of their education. Investors make money, medical students pay less… It is a WIN-WIN proposition!

The loans would have a low probability of default; most medical students ultimately take residencies and move into the working world from there. The benefits to investors include a reliable return on investment and an opportunity to do good for society.

The program has received some coverage in the press. I have met with numerous federal and state legislators, such as Senator Chuck Grassley (pictured at left); and I have an upcoming meeting with Iowa Governor Terry Branstad to discuss tax incentives for investors to make this financial tool a competitive alternative to current investment options.

The program has received some coverage in the press. I have met with numerous federal and state legislators, such as Senator Chuck Grassley (pictured at left); and I have an upcoming meeting with Iowa Governor Terry Branstad to discuss tax incentives for investors to make this financial tool a competitive alternative to current investment options.

We owe it to the future of health care to make medical school as financially feasible as possible to as many students as possible. Please lend your support.

(comic: medical school debt / shutterstock)