Since January 2011, we have identified 158 medical technology companies that have been founded globally. As in the past when we have discussed “medtech” companies, whether in the context of startups or in fundings, we would like to make clear what we define as medtech:

What is “medtech”?: We view medical technology (medtech) as principally medical devices and equipment, but also all technologies that are directly competitive with or complementary to technologies represented by therapeutic or diagnostic medical devices/equipment.

Since January 2011, we have identified 158 medical technology companies that have been founded globally. As in the past when we have discussed “medtech” companies, whether in the context of startups or in fundings, we would like to make clear what we define as medtech:

What is “medtech”?: We view medical technology (medtech) as principally medical devices and equipment, but also all technologies that are directly competitive with or complementary to technologies represented by therapeutic or diagnostic medical devices/equipment.

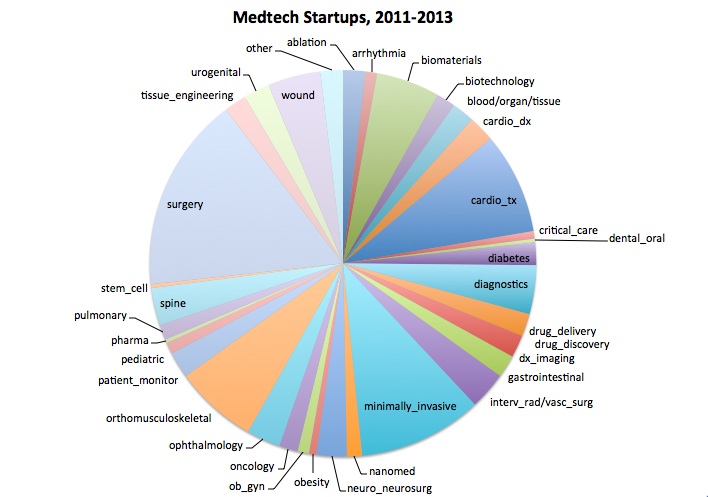

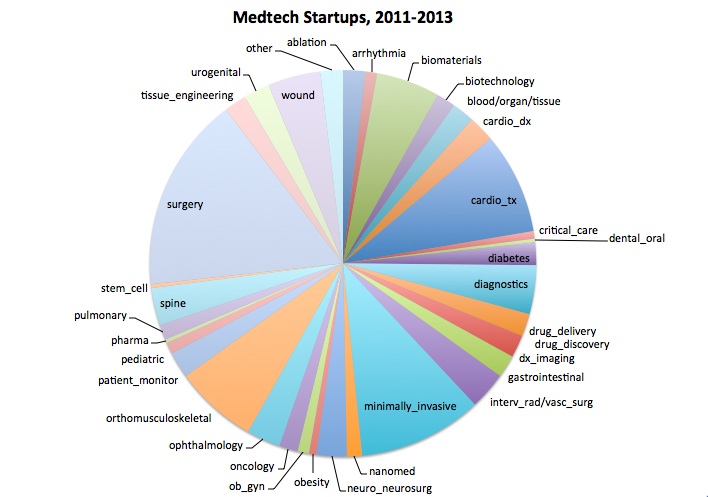

An enormous range of technologies are under development at this company (see our detailed list of technologies from past years at link). For the sake of our database subscribers interested only in specific clinical/technology areas, we categorize the companies accordingly (based on the nature of their technologies or clinical application). Below is represented the distribution of technologies at the companies identified from 2011 to May 2013. Note, please, that multiple clinical/technology categories are possible for each company, so the pie chart below represents the whole not as the total number of companies, but a multiple of the number of companies and clinical/technology areas.

Source: MedMarket Diligence, LLC; Medtech Startups Database.