Has The IRS Used Salami Tactics to Update IRS 501(r)?

Has The IRS Used Salami Tactics to Update IRS 501(r)?

Has The IRS Used Salami Tactics to Update IRS 501(r)?

Has The IRS Used Salami Tactics to Update IRS 501(r)?

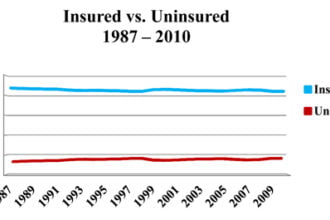

Under the Patient Protection and Affordable Care Act (PPACA), that was enacted March 23, 2010 and amended by the Health Care and Education Reconciliation Act of 2010, the Internal Revenue Service (IRS) has added new requirements for hospital and healthcare organizations to justify their tax-exempt status under the new rules enacted under (IRS) statute §501(c)(3).

The new requirements affect the actions and policies of tax-exempt hospitals mandating that they follow new guidelines concerning serving patients unable to pay for the costs of their medical care. Hospitals and healthcare systems are required to create an internal audit and compliance plan to provide oversight of these new policies.

New Requirements for Charitable 501(c)(3) Hospitals

Section 501(r), imposes new requirements on 501(c)(3) organizations that operate one or more hospital facilities. Each 501(c)(3) hospital organization is required to meet four general requirements on a facility-by-facility basis:

- Establish written financial assistance and emergency medical care policies;

- Limit the amounts charged for emergency or other medically necessary care to individuals eligible for assistance under the hospital’s financial assistance policy;

- Make reasonable efforts to determine whether an individual is eligible for assistance under the hospital’s financial assistance policy before engaging in extraordinary collection actions (ECA) against the individual; and

- Conduct a community health needs assessment (CHNA) and adopt an implementation strategy at least once every three years (these CHNA requirements are effective for tax years beginning after March 23, 2012).

The PPACA also added a new section 4959, which imposes an excise tax for failure to meet the CHNA requirements, and added reporting requirements to sections 501(r) and 4959. If a hospital organization to which section 501 (r) applies fails to meet the requirement of section 4959 for any taxable year, a tax equal to $50,000 is levied.

The regulations allow hospitals flexibility in determining how to implement the 501(r) rules to best meet the needs of the communities they serve, but provide a detailed outline how its hospitals must operate. The regulations will apply for tax years beginning after December 29, 2015.

These policies must be established and applied throughout the hospital organization with close collaboration among regulatory compliance, operations, and billing to ensure proper action is taken to address this tax-exempt status requirement. The following is a summary of the four general requirements:

- Written Financial Assistance and Emergency Care Policies

- The financial assistance policy (FAP) must identify all providers, other than the hospital, delivering emergency or other medically necessary care and whether they are covered under the financial assistance policy;

- The hospital may grant financial assistance based on information from sources other than the individual. Also, the hospital can obtain information from patients either orally or in writing;

- The FAP is only required to disclose discounts under the FAP and not additional discounts the hospital may provide;

- Billing statements must include a noticeable communication of the availability of financial assistance from the healthcare organization; and

- Emergency care administered under Section 501(r) prohibits debt collection activities that interfere with the provision of emergency medical care under the Emergency Medical Treatment & Labor Act (EMTALA).

- Limitations on Charges

- A facility can change the amounts billed (AGB) method it uses at any time; it just needs to update its FAP to reflect the method and percentage discount applied;

- The regulations clarify that the AGB limitation applies only to the amount the patient is personally responsible for paying after deductions, discounts and insurance have been applied;

- Medicaid can be included in the calculation by itself or in conjunction with the other payers;

- The AGB can be calculated based on all services provided by the hospital versus just emergency and medically necessary services; and

- A reasonable allocation of capitated or other lump-sum payments made by an insurer can be incorporated.

- Billing and Collections

- At least one bill post-discharge must contain a plain language summary of the FAP;

- An oral notification of the FAP and how to obtain financial assistance is required once, at least 30 days before initiation of an ECA;

- A summary of the ECAs the hospital intends to follow must be provided to the patient before initiation;

- Liens placed on a portion of potential settlement proceeds when the patient has sued a third party due to an auto accident or other type of accident is not considered a collection action and thus is not an ECA;

- The rule requires hospitals to have a written agreement with third parties (collection agencies) to abide by the 501(r) requirements;

- Hospitals can place accounts with a collection agency within 120-day notification period if they meet the requirements;

- The sale of debt to a third party is not considered to be an ECA. Accounts cannot be sold until after the notification period; and

- The hospital must accept financial assistance policy applications for 240 days after the date of the first billing statement.

- CHNA

- A description of the process and methods used to conduct the CHNA need to be made available;

- A description of how the hospital facility solicited and took into account input from the public;

- An outline that shows a prioritized description of the significant health needs and an explanation of the process and criteria used to identify the health need; and

- A description of the resources potentially available to address the health need.

CONCLUSION

The IRS has used a Salami tactic to increase the scrutiny of tax-exempt healthcare organizations. This has put extra pressure on healthcare organization’s internal auditors and compliance officers to assess risk and appropriately create, implement and monitor their compliance standards.

The Salami tactic employed has allowed “slice by slice” changes to 501(r) to take place over the past five years without much opposition. When stepping back and viewing the broader change over time, it shows clear evidence of its significance. The small slice changes that have been made by the IRS are all connected to an enormous change in the way charitable hospitals must operate to keep their tax-exempt status intact. Section 501(r) is the most significant change to tax exemption standards for hospitals in more than 40 years.

__________________

Phil C. Solomon is the publisher of Revenue Cycle News, a healthcare business information blog. He serves as the Vice President of Global Services for MiraMed, a global healthcare Business Processing Outsourcing services company. Phil has 25 years of experience in healthcare as an industry thought leader, strategist, solution provider, author and featured speaker. In this blog, you will read about important industry updates, strategies for

improving financial performance, and commentary that challenges the status quo.

The post UPDATED POST: Salami Tactics and IRS 501(r) appeared first on REVENUE CYCLE NEWS.