A few of my interns recently did a brain-storming session with me.

A few of my interns recently did a brain-storming session with me. They were all enthusiastic to do something of their own and had many questions. Many of them I met at several accelerator competitions and hackathons.

I am not an authority or a VC. So far, I have invested in 9 companies globally- all in healthcare or education. One thing that I have come across in almost every transaction is when seed funded companies go for Series A- Investor raise red-flags about

1. Recurring revenue

2. Team

3. Valuation

One such situation came in today when I was asked How do you anticipate growth of 15%-20% YOY when in a force of 200 employees you have only 5 sales guys and 2 marketing people. What are you relying on? Most start-ups find it hard to answer such a question.

When you cannot rely on sales and marketing to be your driver of growth, you rely on your customer to be your driver of growth. Hence when the service and the product keep evolving imparting better and sustained value- one needs to rely less on marketing. I think it actually builds a much deeper foundation when you don’t rely on a very large sales and marketing team to get your brand out.

This MIT guy asked me- How would you measure the value of a company? Especially, a company that you started a month ago – how do you determine start-up valuation?

My answer was simple Valuation need not show the true value of the company. Actually what it defines is about investor share in the company. At the time of investment, valuation is the core determinant of return for investors. In other words, the return to investors is based on the increase in the valuation of shares they receive in exchange for their capital. Understanding valuation is critical to successful investing. Unfortunately, valuation is the most misunderstood part of the investment process and often leads to contentious negotiations that get the entrepreneur investor relationship off on the wrong foot.Valuation depends on how much money you need to say run 3 pilots and have 8-12 months of runway. As an Investor, I expect growth in 18 months.

Valuation matters to entrepreneurs because it determines the share of the company they have to give away to an investor in exchange for money. At the early stage the value of the company is close to zero, but the valuation has to be a lot higher than that. Why? Let’s say you are looking for a seed investment of around $100, 000 in exchange for about 10% of your company. Typical deal. Your pre-money valuation will be $ 1 million. This however, does not mean that your company is worth $1 million now. You probably could not sell it for that amount. Valuation at the early stages is a lot about the growth potential, as opposed to the present value.

The biggest determinant of your startup’s value are the market forces of the industry & sector in which it plays, which include the balance (or imbalance) between demand and supply of money, the recency and size of recent exits, the willingness for an investor to pay a premium to get into a deal, and the level of desperation of the entrepreneur looking for money.

The follow-up questions was- Does valuation also depend on who you are taking money from? – I laughed it out. The answer to that is a big “YES” – we all know that.

We have an acquisition offer from a large hospital chain- Tim said- they are interested in Acqui-Hire- Should we take it? How to decide between getting acquired and acqui-hire.

Well. It depends on how your company is doing? Acqui-Hire is offered when you have a great team together but product isn’t going anywhere. Acquisition is the best move when we realise that the product has traction, but the company does not generate enough revenue to qualify for an IPO.

And last but not least- What does an Angel like me look for returns?

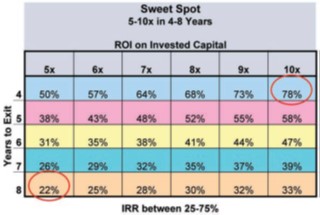

Some angels target 5x to 10x ROI (cash-on-cash return on their investment) in four to eight years, which yields an internal rate of return of between 25 and 75 percent. (In the accompanying table, the target numbers assume that divergence of between 3x and 5x times is factored in.) Other angels simply target 30x ROI without divergence. The two approaches are effectively equivalent:

If you assume 4x divergence (the midpoint between the expected range of 3x to 5x) and multiply that by a return of 7.5x (midway between the 5x and 10x range), then you get 30x, which factors in divergence. These rules of thumb are not sacrosanct; they reflect two common approaches.

Divergence:

Divergence is the difference between the growth rate of the company’s valuation and the

valuation of the shares investors receive due to dilution by subsequent investors and other factors. Even in successful ventures, divergence, in fact, tends to be between 3x and 5x.

A simple example may help make the point: An investor funds at a $4-million post-money valuation and receives shares valued at $2 each. The company is sold in five years for $60 million, which is a 15x increase in company valuation. Due to dilution, however, the value of the investor’s shares will almost certainly not have increased 15x to $30 per share. They might instead have increased only 3x to $6 per share. In this example, the increased valuation of 15x divided by the increase in the investor’s share value of 3x demonstrates a 5x divergence.

A startup company’s value, as I mentioned earlier, is largely dictated by the market forces in the industry in which it operates. Specifically, the current value is dictated by the market forces in play TODAY and TODAY’S perception of what the future will bring.

Effectively this means, on the downside, that if your company is operating in a space where the market for your industry is depressed and the outlook for the future isn’t any good either (regardless of what you are doing), then clearly what an investor is willing to pay for the company’s equity is going to be substantially reduced in spite of whatever successes the company is currently having (or will have) unless the investor is either privy to information about a potential market shift in the future, or is just willing to take the risk that the company will be able to shift the market.

Therefore, when an early stage investor is trying to determine whether to make an investment in a company (and as a result what the appropriate valuation should be), what he basically does is gauge what the likely exit size will be for a company of your type and within the industry in which it plays, and then judges how much equity his fund should have in the company to reach his return on investment goal, relative to the amount of money he put into the company throughout the company’s lifetime.

Comments welcome.

Credits:

http://www.angelcapitalassociation.org/

http://seedcamp.com/resources/how-does-an-early-stage-investor-value-a-startup/

Ewing Marion Kauffman F Foundation

http://www.forbes.com/sites/mariannehudson/2015/03/06/the-art-of-valuing-a-startup/

http://articles.bplans.com/30-questions-angel-investors-will-ask-you/