- Competitive Landscape/Innovator Analysis/Market Innovation Insights

- Percentage Usage of Medical Device Outsourcing/Applications of Medical Device Outsourcing/Relevance of Medical Device Outsourcing

- U.S. Medical Device Outsourcing Market Scenario

- Service Analysis of Medical Device Outsourcing/ Categorization of Medical Device Outsourcing

Grand View Research, a U.S. based market research and consulting company, reported that the U.S. Medical Device Outsourcing market is estimated to be worth USD 15.9 billion by 2025.

The U.S. Medical Device Outsourcing market is segmented on the basis of services, and therapeutic area.

Factors affecting the market growth are as follows:

- Increase in prevalence of chronic disorders such as, diabetes, cardiovascular diseases and spine disorders

- Increasing demand for minimally invasive surgeries

- Rising competition among manufacturers

- Changing regulatory landscape and growing inclination towards outsourcing services

- Loss of confidential information

Competitive Landscape/Innovator Analysis/Market Innovation Insights

Established players in this market are anticipated to widen their portfolio, to sustain the aggressive competition over the forecast period. In July 2017, ICON Plc, a leading CRO, acquired Mapi Group to strengthen its commercial presence and strategic regulatory expertise. The acquisition is anticipated to help Mapi Group expand its global footprints and increase its service portfolio for life science companies.

In September 2016, ICON completed the acquisition of the company Clinical Research Management, Inc. (ClinicalRM). ClinicalRM has a strong client base within the U.S. government along with an extensive expertise portfolio. This acquisition is expected to attract new clients and promote signing of new federal contracts over the forecast period.

In February 2016, TE Connectivity (TE), Switzerland based developer of connectivity and sensor solutions acquired the U.S based developer of minimally invasive medical devices and outsourcing solutions Creganna Medical (Creganna) for USD 895 million. This acquisition is followed by AdvancedCath acquisition and establishes TE as a leading supplier to the minimally invasive interventional segment.

Earlier, in August 2015, Greatbatch Inc. (renamed as Integer Holding Corporation) acquired Lake Region Medical for total consideration of USD 1.7 billion, creating largest medical device outsourcing companies with combined revenues pegged at USD 1.5 billion. With this acquisition, the combined entity is expected to provide new level of industry leading outsourcing services to its OEM customers. With this transformative deal, the combined entity will be at the forefront of the innovative technologies and will bring innovative solutions and services catering to medical device outsourcing market.

Percentage Usage of Medical Device Outsourcing/Applications of Medical Device Outsourcing/Relevance of Medical Device Outsourcing

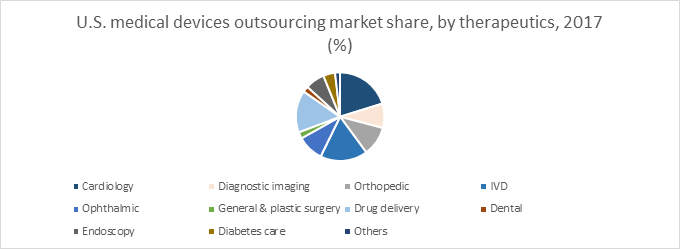

Medical device outsourcing services are needed in different therapeutic areas such as diagnostic testing, orthopedic, in-vitro diagnostics, ophthalmic, drug delivery, cardiology, dental, general and plastic surgery, diabetes care, endoscopy, others.

According to Grand View Research, the U.S. medical device outsourcing market is fragmented into the following therapeutic areas:

The general and plastic surgery, cardiology and drug delivery therapeutic areas are estimated to grow with a CAGR of 13.6%, 12.5% and 11.6% respectively, over the forecast period.

Growing demand for cosmetic surgeries is expected to boost the outsourcing of general as well as cosmetic surgical devices. Surgical devices such as fixation devices, extremity splint, and epilator require specialized molding and machining processes. These devices are usually outsourced to the component/OEM manufacturers. According to the American Society of Plastic Surgeons, in 2015, approximately 15.9 million surgical and minimally invasive cosmetic surgeries were performed.

The increasing incidences of cardiovascular disorders such as myocardial infraction, angina pectoris, atrial fibrillation and congenital heart disease expected to boost the demand of cardiology devices. According to the Centers for Disease Control and Prevention (CDC), in 2015, more than 800,000 people in the U.S. died due to stroke and other cardiovascular disorders. The high number of deaths is contributing towards the growth of this industry as increasing number of medical practitioners and patients have understood the necessity of the early diagnosis and treatment of these disorders.

Drug delivery devices such as cypher stents, intrauterine devices, and transdermal implants are the key products outsourced in this segment. Services, which are outsourced for drug delivery devices include testing, quality maintenance, sterilization, and packaging. For these types of devices, it is required that they should be inert, free from contaminants, and accurate. Additionally, outsourcing for combination products is also a prevailing trend observed in the market.

U.S. Medical Device Outsourcing Market Scenario

The U.S has highest per capita GDP of USD 46,760 and per capita health expenditure of USD 7,720. This country has the most sophisticated healthcare system. Moreover, the prevalence of chronic disorders is greater here than the global average. For instance, the number of cancer incidences per year is 300.2 in 100,000, which is much higher than the global average, thus contributing to the dominance in the medical device outsourcing market.

Within the U.S., New York and Pennsylvania are estimated to have the maximum demand for medical device outsourcing. The demand is estimated to be high in these states, due to the high prevalence of chronic diseases, and rising presence of Ambulatory Surgical Centers (ASC). The demand for minimally invasive surgeries is also increasing in the country, which in-turn is anticipated to drive the demand for medical device outsourcing.

Service Analysis of Medical Device Outsourcing/ Categorization of Medical Device Outsourcing

The U.S. medical device outsourcing market is segmented into regulatory consulting, product designing and development, product testing and sterilization, product implementation services, contract manufacturing, product upgrade and product maintenance services, based on service. Contact manufacturing held a significant share in 2017. This segment is anticipated to grow at a lucrative rate of 11.1% over the forecast period.

Medical device market players are striving to reduce cost as profit margins are shrinking. To curtail fixed costs, companies are implementing shift work. In addition, small and medium sized companies lack in skilled labor and technical resources to complete the project. To remain competitive in the industry, companies collaborate with the contract manufacturers.

Contract manufacturing segment is further classified into accessories manufacturing, assembly manufacturing, component manufacturing and device manufacturing.