Summary: What will you decide for your organization beginning 2015? Will you “play or pay”?

The “play or “pay” principle basically says that if employers with 50 or more full time employees don’t meet the minimum requirements of offering insurance coverage, they will pay very steep penalties. The provision will be phased in beginning in 2015. The “play or pay” principle is part of the PPACA, specifically under the provision of “shared responsibility”.

“Play” – “Play or Pay”

So, what are those minimum requirements?

Summary: What will you decide for your organization beginning 2015? Will you “play or pay”?

The “play or “pay” principle basically says that if employers with 50 or more full time employees don’t meet the minimum requirements of offering insurance coverage, they will pay very steep penalties. The provision will be phased in beginning in 2015. The “play or pay” principle is part of the PPACA, specifically under the provision of “shared responsibility”.

“Play” – “Play or Pay”

So, what are those minimum requirements?

Coverage

A full time employee for the purposes of the “play or pay” principle is an employee who works at least 30 hours, regardless of status as determined by the employer. This extends to part time and PRN employees who meet this criteria. Additionally, the plan must contain the essential health benefits as set forth by the US Department of Health and Human Services. It is important to note that these essential health benefits may change from time to time and therefore must be monitored closely.

2015: Employers must offer coverage to at least 70% of their full-time employees and their dependents (up to age26), providing they have at least 100 full-time employees.

2016: Employers must offer coverage to at least 95% of their full-time employees and their dependents (up to age 26), providing they have at least 50 full-time employees.

Value

In terms of the Employer Mandate, a.k.a. “play or pay”, insurance plans must provide value. Value, in this context, refers to an employer not only offering coverage, but coverage through a plan in which at least 60% of covered services (including deductibles, copays, and coinsurance). While this seems like a fairly simple calculation, it can be quite complex. The HHS website provides a value calculator to assist you in meeting this requirement, https://www.cms.gov/CCIIO/Resources/Regulations-and-Guidance/Downloads/mv-calculator-methodology.pdf.

Affordability

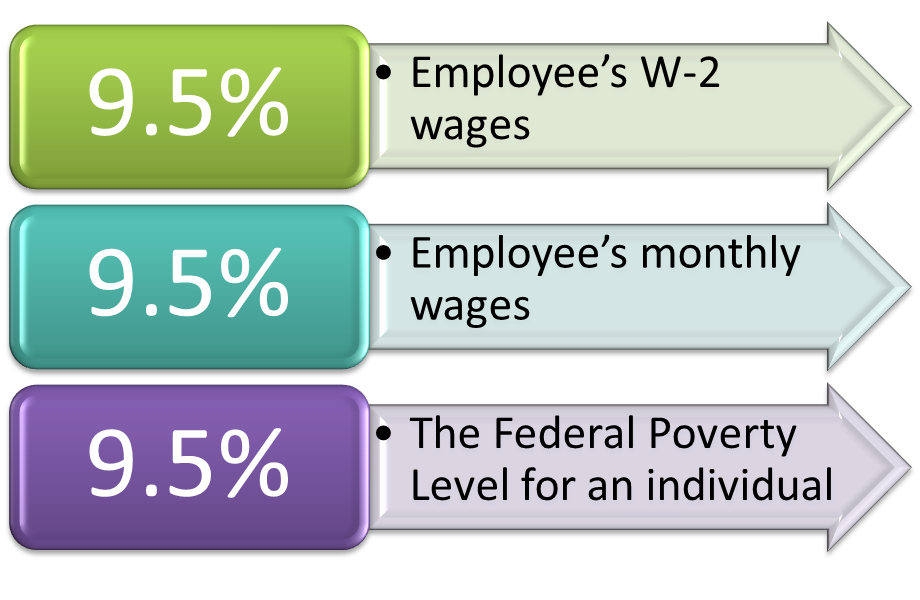

The regulations are very clear on the affordability aspect of the “play or pay” principle. The threshold is 9.5% of an employees’ household income. The 9.5% can be calculated as a percentage of any of the following safe harbors:

“Pay” – “Play or Pay”

We have talked about the “play” portion of “pay or play”. Now let’s focus on the “pay” aspect. Perhaps you are thinking that with all of this complexity, it may just be easier and cheaper to take the penalty and move on. Well, you may or may not know just how steep they can be:

Example: You have 1,000 employees

Scenario A: You don’t offer any coverage

- Penalty: $2,000 *970 employees = 1,940,000

- There is a slight discount in which the first 30 full time employees are exempt from the calculation

- Do you have almost $2,000,000 that you can just throw away? Not many organizations do.

Scenario B: You provide coverage but it doesn’t meet either the affordability or value test.

- Penalty: the lesser of:

- $2,000 *970 employees = 1,940,000 or

- $3,000 * the number of employees who purchase insurance on the exchange and are eligible for a subsidy, let’s assume 500. $3,000 * 500 = $1,500,000

How will the government know if you are not “playing” by the rules?

The trigger is going to be if any of your employees purchase insurance through the healthcare exchanges and are eligible for subsidies. One individual will trigger an audit of your organization in terms of coverage, value, and affordability.

“Play or Pay” – Other Considerations

There are other factors to consider when deciding whether to “play or pay”.

- Can you quantify what you are currently spending to provide insurance to your employees?

- Can you quantify the amount you are receiving as a tax deduction for providing insurance?

- How will not providing insurance affect your employee’s taxes if they are no longer able to have premiums paid on a pre-tax basis?

- Can you afford a mass exodus due to benefit cuts?

- Are you easily able to calculate the 9.5% threshold for each employee?

- Are you tracking all of the hours per employee including disability, paid time off, etc.?

Can you afford to “pay”? Can you afford these steep penalties? What are your thoughts on the employer mandate? What are your deciding factors when faced with the “play or pay” dilemma?