Don Taylor (The Incidental Economist) on the origins of the subsidy:

Don Taylor (The Incidental Economist) on the origins of the subsidy:

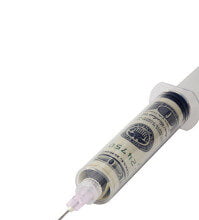

Flood insurance is provided in the United States by the federal government via the National Flood Insurance Program (NFIP), in two ways. First, the government directly provides coverage for some properties. Second, the government works in concert with around 90 private insurers who function as servicing contractors. In the second case, the profits from such flood insurance are private, but the losses are socialized as private insurance companies bear none of the underwriting risk associated with this insurance. How did this come to be the case?

Suzy Khimm (at Ezra Klein’s blog) on perverse incentives:

A significant chunk of flood insurance is offered at federally subsidized rates in areas vulnerable to natural catastrophes. A quarter of participants pay below “full-risk” rates, many of whom receive a subsidized or “grandfathered” premium, according to the GAO. As a result, more Americans have moved into low-lying, flood-prone areas since the creation of the NFIP. And the taxpayers have had to cover the risks, which often means additional aid to disaster-struck areas.

Yglesias: America’s worst federal spending is generally its least controversial.

Don Taylor: compares flood insurance to Medicare.