In terms of the evolution of public policy, the “health policy community” failed at health planning, failed at hospital rate setting, failed at Certificate of Need, and failed to do anything about uncompensated care.

Not only had it failed, but it spent fortunes and destroyed lives in the process.

In terms of the evolution of public policy, the “health policy community” failed at health planning, failed at hospital rate setting, failed at Certificate of Need, and failed to do anything about uncompensated care.

Not only had it failed, but it spent fortunes and destroyed lives in the process.

Then the same people turned their attention to the uninsured. I mean literally, the exact same people. The people who were unable to tell hospitals what facilities should be built or how much to charge for their services decided they could reorganize the insurance business. Hubris? Ya think?

This opened up a whole new world for them. Suddenly they had to learn some of that insurance lingo so they could sound like they knew what they were talking about. Suddenly health policy academics were buzzing with terminology like “risk pooling” and “adverse selection.” Unfortunately, they couldn’t quite grasp the meaning of the terms.

Take risk pooling. These health policy elite use the expression “risk pool” in two contradictory ways. Both are wrong.

First, they think of it as a giant pool of unallocated money everyone contributes to, and withdraws from when they have a need. They see it like taxes. Everybody pays taxes, which can then be fairly allocated based on each person’s need (and the whim of the government.) Some people will have a lot of needs, others not so much, so we need lots and lots of people contributing to the pool so that no one person will have to pay too much. The bigger the pool, the better.

The other way they use it is to defend employer-sponsored health insurance over individual coverage. Employer coverage is better, they think, because it pools risk.

Let’s start with the first one — the giant pool of money. This understanding places the emphasis on “pool” and ignores “risk.” It leads to a “tragedy of the commons” phenomenon in which every member of the pool tries to grab as much as he can before it is depleted.

The emphasis should be on “risk.” What is being pooled is the risk of a loss, an adverse event. The point is not to have a giant pool of money, but a pool of people (risks) large enough to cover expected losses. A risk is (and must be) an uncertainty. No one can know ahead of time who will incur a loss or when it will happen. But, it is possible to calculate the likelihood of losses for a large group of people, and divide that likelihood by the number of people covered to determine how much each should pay to cover these losses.

Each individual member of the group may have a higher or lower likelihood of incurring a loss and ideally there will be a mix of people to balance out the probabilities. Most insurance will assess each member’s risk and adjust the premium to reflect that greater or lower risk. Obviously these rate adjustments do not account for all of the variation in risk or there would be no point in having the insurance in the first place. Most members of the pool will pay far more than they will collect in benefits, but we are willing to make that payment “just in case” something bad happens. Even with spending all that money, we would much prefer to never collect. It is far better to never be in a traffic accident or have your house burn down regardless of how much you pay for insurance.

Importantly, in this scenario there is no pool of unallocated money. Each dollar is contractually obligated to pay for a loss. We have a contract with the insurance company that we will pay $Y premium to get $X benefit in the event of a loss.

Now, a risk pool does need a minimum of enrollees to be effective, but it is simply not true that the bigger the pool the better. Actuaries generally set the minimum number at 25,000 covered lives and place the optimal number at about 60,000. See, for instance, Elinor Hall, “MediCal Managed Care Models Context Considerations,” March, 24, 2006.

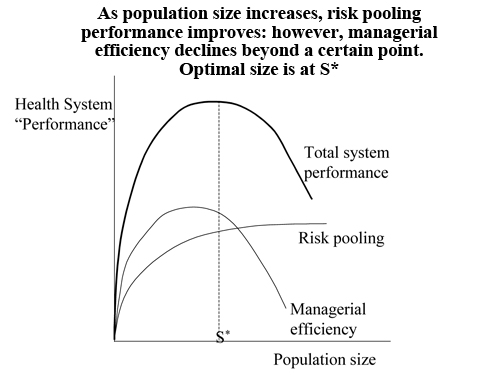

This number provides all of the advantages of risk sharing that are possible. There may be some economies of scale in exceeding that number, but these, too, are limited. A study by the World Bank found that the efficiency of any health insurance arrangement peaks at some number determined by both the size of the pool and the limits of managerial efficiencies. (See graph.)

This raises the other use of the term that policy makers have been using — that employers are good vehicles for insurance coverage because they “pool risks.”

No they don’t. Employers actually concentrate risk. A national employer with over 25,000 workers may be a reasonable risk pool, but the employees of a 75-person print shop are likely to be more like each other in their risks than the general population. They work in the same place, live close to each other, are of similar ages, incomes, and education, and are exposed to the same environmental hazards. Further, they expose each other to the same diseases.

Employer-based coverage may have some marketing efficiencies over individual coverage, but it is the insurance company’s job to be a risk pool, not the employer’s.

In a future post, I’ll look at one of the consequences of this misunderstanding of risk pools — mandated benefits.