After years of trying to do something about health care costs, especially hospital costs, through programs like National Health Planning, Certificate of Need, and Hospital Price Controls, the “health policy community” discovered the problem of Uncompensated Care. This, in turn, led to the discovery of The Uninsured — presumably the cause of Uncompensated Care (we are using proper nouns because these issues all quickly morphed from mere descriptions into titles for Great National Emergencies, like World War Two or the Great Depression).

After years of trying to do something about health care costs, especially hospital costs, through programs like National Health Planning, Certificate of Need, and Hospital Price Controls, the “health policy community” discovered the problem of Uncompensated Care. This, in turn, led to the discovery of The Uninsured — presumably the cause of Uncompensated Care (we are using proper nouns because these issues all quickly morphed from mere descriptions into titles for Great National Emergencies, like World War Two or the Great Depression).

This was a breakthrough. Here at last was an issue that would keep all the health policy wonks employed for a very long time. It is an issue that can never be solved! It can be converted into an annual CRISIS as each year the Census Bureau came out with new numbers and a new excuse to create new hysteria.

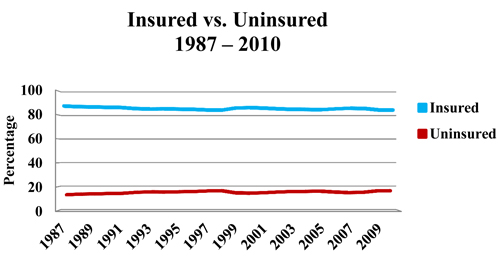

But, as the chart below shows, it has been about as stable a problem as anything could be. From 1987 through 2010 the proportion of the insured and uninsured has barely budged from roughly 85% insured and 15% uninsured. It has stayed the same during several recessions (1981, 2001, and 2009) and during boom times. It has stayed the same despite massive efforts by state and local governments to expand Medicaid, reform the insurance market, develop (and abandon) all kinds of “universal healthcare” programs, and grow new federal programs like S-CHIP.

Source: U.S. Census Bureau Historical Tables

http://www.census.gov/hhes/www/hlthins/data/historical/orghihistt1.html (1987 – 2004) http://www.census.gov/hhes/www/hlthins/data/historical/files/hihistt1B.xls (2005-2010)

Actually, this whole dichotomy — that there is one group of Americans who are insured and another group who are uninsured — is false.

In fact, the American economy is dynamic, fluid, and diverse — and so is the uninsured population. This is beyond the comprehension of most of the academic elite, which wants to place everything in tidy little boxes.

Americans change jobs all the time. They have part time jobs, they are independent contractors, they work on commissions, they will take several jobs at the same time, they supplement their income by selling Avon or restoring houses in their spare time, they move from town to town and state to state, they will take six months off between jobs to go to school or travel to Europe, they live off their savings, or sponge off girlfriends and boyfriends, they engage in barter, they win lawsuits or a lottery, they receive a substantial inheritance. To the extent health insurance is job-based, it will always be “unstable.” It will come and go along with the jobs.

Health insurance, too, is diverse. Some policies are very rich; others are skimpy; some(like Medicaid) are rich on paper but pay physicians so little that it is difficult to get services. The people who are least likely to have health insurance are young adults in their 20s. These are also the people who are least likely to need health care services. They are also the people who are least able to afford insurance premiums since they are just starting out in their careers or change jobs frequently while deciding what they want to do in life.

None of this is bad. In fact, it is good because it is a reflection of the real needs and priorities of real people. It is an appropriate allocation of their scarce resources. Even “uninsured” young adults are likely to be insured for the things most likely to happen to them — traffic accidents and work place injuries. Young women, who may need more health services than young men, are far more likely to have it. At age 21 to 24, 35% of men are uninsured, compared to 28.8% of women. At age 25 to 34 it is 30.2% of men and 21.7% of women.

In fact, no one is insured for everything. In that sense, we are all partially uninsured. There is nothing wrong with that. Even people who are well-insured may not be able to get health services when they need them. The point of having insurance is not to have a card in your wallet, but to finance needed health services. Health insurance finances these services on a prepaid basis — we pay a little bit ahead of time every month so that the insurance company will pay the bill when it is incurred.

That is one legitimate way to finance the services, but it is not the only way and may not be the best way. It is every bit as legitimate to incur the bill and finance it through a credit card or bank loan. That loan is paid off in monthly increments after the service has been received.

Using health insurance is like a lay-away program at K-Mart. It is fine as far as it goes, but imagine trying to finance a car or a home that way. For those kinds of big purchases a bank loan is far more useful. Taking out a loan to finance expensive care will result in finance charges. But with pre-payment, one loses the value of the money while K-Mart (or the insurance company) holds on to it and adds their own administrative charges for managing the money.

For those reasons, it is actually more efficient to simply pay cash at the time of service whenever possible. One saves the financing cost of post-payment, and one saves the administrative and lost opportunity cost of pre-payment.

So, insurance has a role to play to health care financing, but it is foolish to think that it should have the sole or even primary role.

Next time, we’ll take a look at what is insurance, and what it is not.