One of the long-standing problems in the individual health insurance market is collecting premiums.

One of the long-standing problems in the individual health insurance market is collecting premiums.

One of the long-standing problems in the individual health insurance market is collecting premiums.

One of the long-standing problems in the individual health insurance market is collecting premiums.

The individual market is largely made up of people with tentative work histories. They may be self-employed or seasonal workers with surges of income, or they may work several part-time jobs, or they may even be fully employed in good paying positions but their employers don’t provide coverage.

In any of these cases, individuals are required to pay their own premiums in a timely fashion, even when money is tight in a given month. Insurers try to avoid lapses in payment by requiring automatic withdrawals from bank accounts, credit card back-ups, or prepayment of premiums on a quarterly basis. Like other businesses, the insurer may provide for a grace period of a week or so, but failure to pay means cancellation of the policy.

Coping with these issues is one of the reasons individual coverage has higher administrative expenses than group coverage.

It will be more than a little interesting to see how the Affordable Care Act deals with these problems, especially since cancellation means people will be in violation of a federal mandate.

Many people eligible for exchange coverage do not have bank accounts or credit cards. That is why inner city neighborhoods have storefronts that cash checks and issue money orders. Many people have surges of income, working one month but not the next, or collecting commissions one month and not the next. Many people have financial emergencies ― their transmission breaks down or they are out sick for two weeks, or their boyfriend moves out of the house ― they don’t have the money to pay their premium this month. We know these things will happen ― a lot.

So far, the regulations coming out of Health and Human Services are not encouraging (see pages 18337, 18387, 18394 and 18471 of the Federal Register.) As you might expect, the regulations are being written by people with nice bureaucratic jobs and steady paychecks. They have no idea what it is like to scramble to make ends meet.

It’s not that they haven’t tried. Lord knows they have issued more regulations than it would take to put a man on the moon. But they are illustrating the limits of the regulatory process. Regulations always mean “you must do Y, but you may not do X” ― as if every contingency can be anticipated from an office in Washington. So, rather than allowing insurance carriers to collect premiums in the ways they know will work, HHS has created a whole new and very restrictive method that must be followed to a “T.”

In this case, the bureaucrats realize that some people will have a hard time paying their bills, even when the bills are partially subsidized. So they have generously provided for a 90-day grace period for paying premiums ― but only for people who are getting a federal subsidy. None of this applies to people who are not subsidized.

The problem with a 90-day grace period for premium payment is that at the end of it you must pay for three months of premiums, when you couldn’t afford to pay one month in the first place. A lot of people won’t be able to do that, but meanwhile they have been running around with an insurance card receiving health services.

What then? Who is on the hook for those services? HHS has decided to split the baby. The insurance company will have to pay for the first month of non-coverage, but providers (doctors and hospitals) will have to absorb the costs incurred for the second two months. That could be a whole lot of money. The (formerly) insured person will be canceled after three months, but they get to re-enroll again at the end of the year without penalty. (And we were told one of the purposes of this law was to solve the “free-rider” problem. Oh, well.)

Along with paying for services during the first month of the delinquency, the insurer must: 1) notify HHS of the non-payment; 2) notify providers of the possibility of denied claims during the second and third months; 3) notify the insured that he/she is delinquent; 4) continue to collect the advanced tax credit on behalf of the policyholder; 5) return the tax credit for the second and third month to the Treasury; 6) issue a termination notice to the insured at the end of the grace period. Oh, and the carrier must also determine whether the insured has a disability as defined by the Americans With Disabilities Act, and make “reasonable accommodations” for such individuals. These are pretty substantial administrative burdens, and the costs will aggravate the Minimum Loss Ratio requirement for the carrier.

So, how many people do you suppose will do this? I would wager just about everybody. Why not? You can get 12 months of coverage for nine months of premiums and suffer absolutely no penalty.

Did somebody say, “Train wreck?”

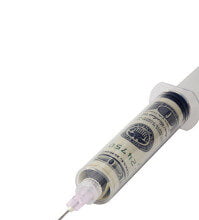

(ACA and premiums / shutterstock)