What is the path forward for physicians who want to remain in private practice, outside the constraints of health system employment? How will the environment change and what new demands will that place on practices and physicians? What follows are the observations of one industry-watcher who has worked on all sides of health care, but who now spends most his time focused on the interests of those who pay for it. No crystal ball, but several trends are clear.

What is the path forward for physicians who want to remain in private practice, outside the constraints of health system employment? How will the environment change and what new demands will that place on practices and physicians? What follows are the observations of one industry-watcher who has worked on all sides of health care, but who now spends most his time focused on the interests of those who pay for it. No crystal ball, but several trends are clear.

There are now concrete signs that health care’s purchasers are exhausted and seeking new solutions, that a competitive marketplace is emerging and getting increasing traction. As they abandon ineffective approaches, the paradigm that has dominated the industry for the past 50 years will be upended. The financial pressure felt by buyers will transfer to the supply side health industry that has come to take ever more money for granted.

For decades, fee-for-service payment, inclusive health plan networks, and a lack of quality, safety and cost transparency have been enforced by health industry influence over policy, effectively neutralizing the power of market forces.

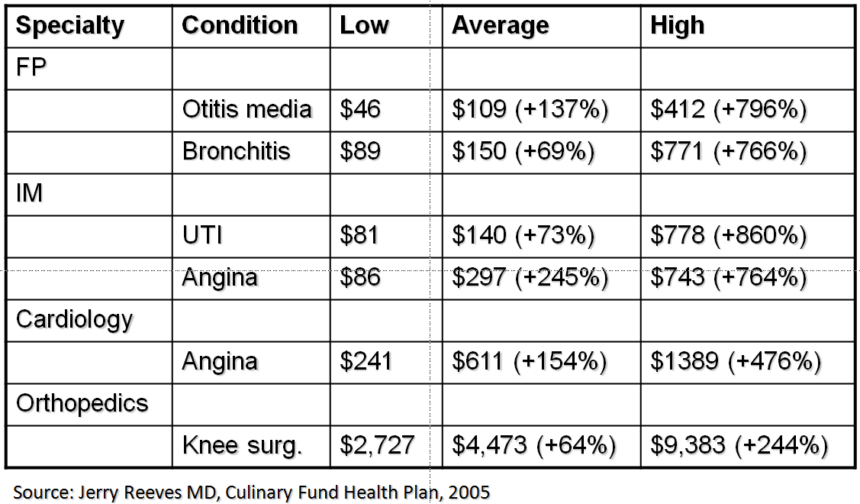

Without market pressure, physicians have felt little need to understand their own performance relative to that of their peers. The variation of physician practice patterns within specialties has been high, with some physicians’ “optimizing their revenue opportunities” by veering wildly away from evidence-based practice. Even so, until recently in this dysfunctional environment, it has been nearly impossible to identify high and low performers.

The impacts of this variation on cost have been staggering. Health care premiums – where costs throughout the system converge – have grown 4.5x times as fast as general inflation for more than a decade. Over the same period, personal health care expenditures – contributions to premium and out-of-pocket payments – have consumed $4 of every $5 dollars of the growth in household income, and the percentage of working age Americans (and their children) with private coverage fell by 14 percent.

While implementation of the health reform law dominates the health care news, there is little in it that will substantially drive down cost or improve quality, at least in the near term. The much-heralded Accountable Care Organization (ACO) program is still mostly based on fee-for-service reimbursement, allowing the rank and file of health systems to cruise without really changing care and cost patterns.

At the same time, though, a mushrooming cottage industry is dedicated to disrupting the many ways that health care organizations profiteer. Most are within niches – e.g., primary care, evidence-based formularies, chronic disease management, oncology benefits management – but a few have taken a more multi-vectored approach.

One of the most powerful of these mechanisms is the narrow, high performing network. A core tenet here is that “choice” in health care, particularly in the absence of performance information, is a false value. Giving patients’ access to doctors who consistently produce poorer outcomes at higher episodic cost does nobody any favors.

The logical solution is to identify physicians who produce better care at lower episodic cost, then contract with and steer to them. The smart money will also pay them higher rates for excellence.

Evaluating physicians is not difficult. It requires medical/surgical, full continuum regional claims data sets large enough to yield credible patient sample sizes for specific conditions. Snapshots in time or more longitudinal data will do. Analytics can help purchasers zero in on high vs. low performers, so they can steer to the high performers and, just as importantly, avoid the low ones.

My rapidly growing firm – we develop and operate work site primary care medical home clinics that become aggressive medical management platforms for mid-sized and large employers – directly contracts significant cost reductions for a range of services, including drugs, advanced images, ambulatory surgeries and pain management. In the process, we focus on identifying the subset of physicians who are most likely to produce better health at lower episodic cost for our patients.

The point here is that a rapidly growing cadre of sophisticated purchasers – the early adopters are in large corporations but benefits managers in smaller self-insured firms are catching on as well – now realize that buying value requires scrutinizing physicians and other providers. Narrow networks built on this approach are exploding around the country. One firm I recently encountered has developed narrow regional provider networks in 138 markets around the country. The premium costs of members of Savannah Business Group, a small regional business health coalition that uses data to identify high performing providers and then contracts directly with them, are significantly below those of non-members in the same metroplex.

Last year Walmart contracted with six Centers of Excellence – Mayo, Cleveland, Geisinger, Scott and White, Mercy Springfield and Virginia Mason – for costly heart, spine and transplant procedures. Not only did Walmart get very favorable pricing, but each system agreed to share its protocols, share data associated with the procedures, and work collaboratively on transitions with each patient’s local physicians. Think through the economic impact this one maneuver has had for Walmart, as well as for local health systems, and the power of the approach becomes evident.

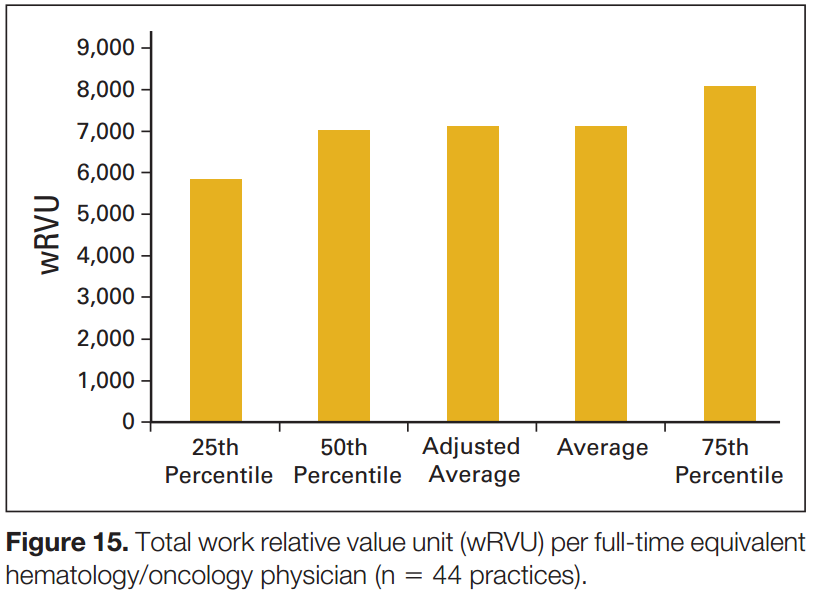

Obviously, if purchasers are intent on understanding physician performance, it makes sense for physicians to understand their own as well. Oncology Metrics is a firm that aggregates, analyzes and benchmarks clinical, resource, productivity and financial data from oncology practices around the country. Practices and physicians receive detailed information about how they compare to their colleagues, which provides a basis for understanding what needs improvement. Physicians without access to this kind of information are flying blind in terms of market capability.

Obviously, if purchasers are intent on understanding physician performance, it makes sense for physicians to understand their own as well. Oncology Metrics is a firm that aggregates, analyzes and benchmarks clinical, resource, productivity and financial data from oncology practices around the country. Practices and physicians receive detailed information about how they compare to their colleagues, which provides a basis for understanding what needs improvement. Physicians without access to this kind of information are flying blind in terms of market capability.

The business requirements of becoming market competitive are enormous. Practice efficiencies become critical, so it may make sense to participate in groups and management services organizations that offer shared arrangements on practice management, billing/collections, human resources, health information technologies, group purchasing, and other mission-critical functions. At the same time, better real time sharing of patient information with other physicians becomes essential to care coordination, which in turn can positively impact quality and cost outcomes. And, in an environment that must ultimately move away from fee-for-service to some form of risk, an ability to confidently manage a population of patients within parameters is paramount. Larger practices with more resources are necessary to finance the infrastructure required for this level of management, as well as to facilitate the team-based care that is needed to optimally manage clinical and financial risk.

When markets work, they lavish rewards for excellence and are unforgiving of mediocrity. Look at Toyota and Chevrolet, Google and Hewlett Packard, Costco and JC Penney. Health care has largely evaded the disciplines of the marketplace for decades, at immense cost to American patients and purchasers.

Enough financial pressure has now built that that time appears to be fading. Physicians will succeed who understand that the challenge is as much in business as clinical processes. Those who simply hope for the best probably will not.